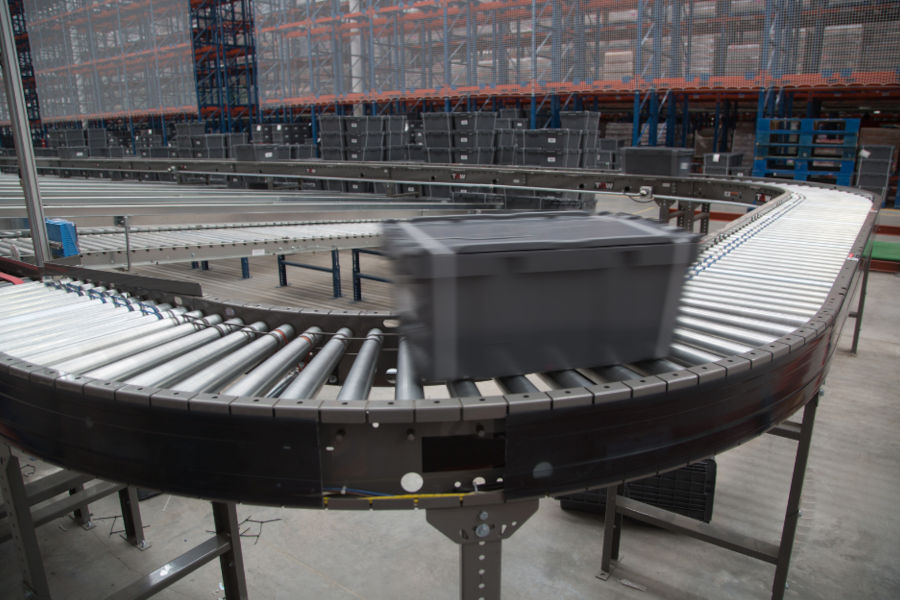

MASTERING COLOR CODING: 11 ESSENTIAL TIPS FOR YOUR FACILITY

Did you know that a well-implemented color-coding system can drastically improve safety and efficiency in your facility? In today’s fast-paced work environments, the need for clear communication and organized operations is more important than ever. With a simple yet effective color-coding strategy, you can enhance productivity, reduce errors, and create a safer workspace. In this […]

Continue reading